Millions Facing 'Household Debt Crisis', Warns Christians Against Poverty

Millions Facing 'Household Debt Crisis', Warns Christians Against Poverty

THE NEWS

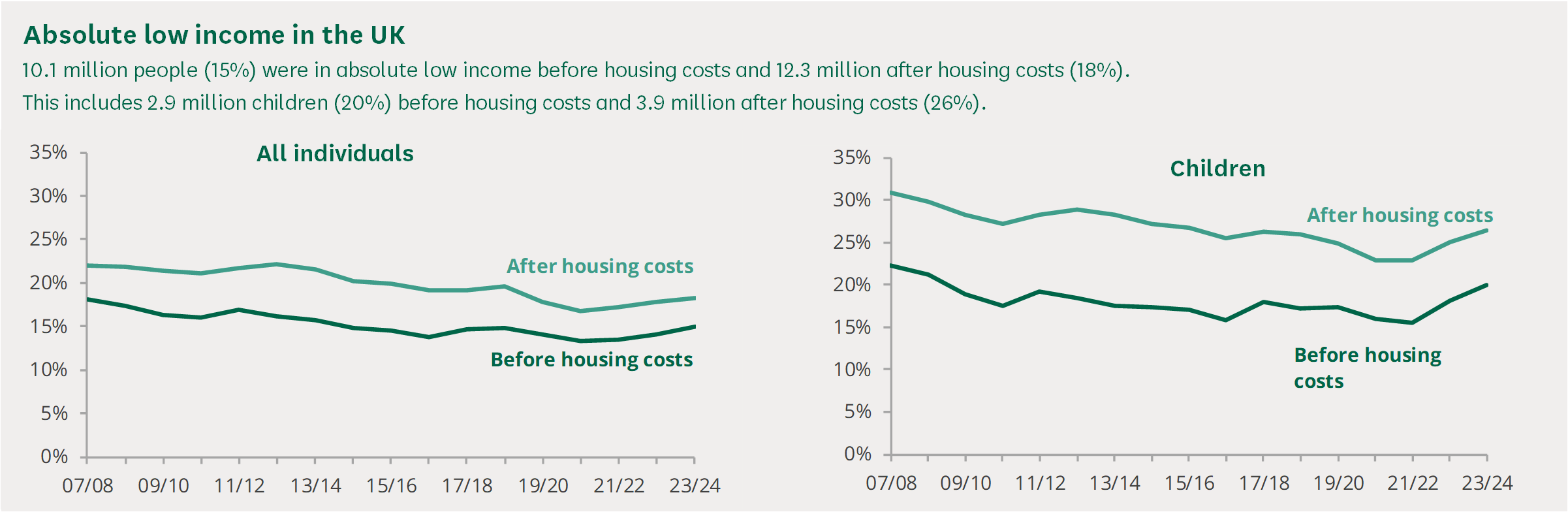

Millions of UK households are facing a deepening debt crisis as the cost of living continues to squeeze families across the nation, according to Christians Against Poverty.

The Christian charity's latest research reveals that 12.5 million UK adults are experiencing daily anxiety about their finances. CAP's polling shows that 28% of adults across the UK are skipping meals and 13% are going without electricity or gas at least monthly as a result of recent increases in the cost of living.

Nearly 12% of parents of children under 18 reported going without food in the past year to ensure their children had something to eat, according to polling by Opinium on behalf of CAP. Around 59% of respondents admitted they had been forced to borrow money just to cover their usual grocery shopping, while nearly three quarters (72%) said they had to sacrifice healthy food because they simply could not afford it.

The financial insecurity has put strain on people's relationships, contributing to 1.8 million relationship breakdowns. It has also impacted mental wellbeing, with 56% saying their mental health has been negatively impacted by the cost of living crisis. Additionally, 3 million UK adults have been unable to progress at work or take new job opportunities due to financial constraints.

CAP's data shows that low income is the main contributor to debt, with three in five clients (60%) needing to borrow money to pay household bills. Around the same proportion of new clients in debt were earning below the poverty line and had borrowed money to pay for food, clothing, and other basic living expenses. One in seven said they had skipped meals on a daily basis, and two in 10 said they were going without heating in cold weather.

Nearly a fifth (17%) of UK adults have used credit cards, overdrafts, or loans to cope with rising costs, with 4.2 million people also turning to friends and family to borrow money. Overall, 42% of UK adults have borrowed money this year, with 40% of this group borrowing more than £1,000.

The crisis hits hardest for those on the lowest incomes. Nearly a third (30%) of low income households are behind with their bills, compared with 13% of all UK adults. Additionally, 63% of people in the lowest income bracket (earning less than £15,000 a year) have been struggling since 2021 or before.

CAP's latest client report highlighted that 85% of people they help feel isolated by their debt, and more than half (52%) admitted they were afraid to even leave their homes. Additionally, 78% fear answering the phone, 82% are worried about opening the post, and 62% are frightened by a simple knock at the door. Before their local church stepped in with CAP's help, 49% of clients had considered suicide as a way out.

Last year, CAP responded to over 15,000 calls to their helpline and provided specialist debt help for over 8,000 individuals. Over 2,000 people reached the milestone of becoming debt free. However, CAP had to turn away over 4,000 people due to a lack of resources or because they didn't have a debt centre near them.

Stewart McCulloch, CEO of Christians Against Poverty, said that two years of high living costs have left many low income households across the UK "trapped under the rubble of debt and poverty." He called for an increase in funding for free debt advice to stop more households falling into crippling debt.

CAP works with over 800 affiliated churches across the UK to deliver free debt help, budgeting guidance, support to find work, life skills groups, and more.

THE CRUSADER'S OPINION

Parents are skipping meals so their kids can eat. Families are choosing between heating and food. Millions are borrowing money just to buy groceries. And half of the people seeking help have considered suicide as a way out.

This is Britain in 2025. One of the wealthiest nations on earth. And millions of its citizens are trapped in crushing poverty.

Christians Against Poverty is sounding the alarm. 12.5 million adults wake up every day anxious about money. 85% of their clients feel isolated by debt. Parents are sacrificing healthy food because they can't afford it.

This isn't a financial crisis. It's a humanitarian crisis. And it's happening right now in our communities.

Where is the Church? Right there in the trenches. CAP partners with over 800 churches delivering free debt help. Last year they helped over 8,000 people and saw 2,000 become debt free.

But they had to turn away 4,000 people. Not because they didn't want to help. Because they didn't have the resources.

This is where Western Christians need to wake up. We spend billions on building projects and programs. Meanwhile, families in our own neighborhoods are choosing between eating and heating.

The early Church was known for taking care of widows and orphans. For sharing resources so no one went without. For radical generosity that made the watching world say, "See how they love one another."

What do people say when they watch us today?

CAP's research shows that before churches stepped in, 49% of their clients had considered ending their lives. Debt doesn't just steal money. It steals hope. It steals dignity. It steals the will to live.

But when the Church shows up with practical help and genuine love, lives are transformed. Not just financially. Spiritually.

This is the Gospel in action. Not just preaching about Jesus. Being Jesus to people drowning in debt and despair.

The solution isn't government programs alone. It's the Church doing what the Church was always meant to do. Meeting real needs with real love.

TAKE ACTION

Christians Against Poverty https://capuk.org/

Free Debt Helpline: 0800 328 0006

Email: [email protected]

Donate to CAP's Emergency Appeal https://capuk.org/urgent